- An SR-22 is a simple one-page document that’s required after a DWI or DUI

- It’s required after a serious traffic or insurance violation to prove that you carry a minimum amount of car insurance

- While an SR-22 itself only costs about $25, you can expect your insurance premiums to increase by an average of about 36%

An SR-22 is an insurance document that’s required after a DWI or DUI. Insurance companies issue these forms to high-risk drivers. The document proves to your state that you carry at least the minimum car insurance mandated under state law. Most, but not all, states have SR-22 requirements.

The SR-22 forms vary slightly in appearance from state to state, but it's typically a one-page document. In some states, SR-22s go by different names, such as S-22 bonds, FR-44s, or certificates of financial responsibility.

Typically, an SR-22 is mandated after any severe traffic or insurance violation, such as being convicted of DWI.

What is SR-22 Insurance?

SR-22 insurance refers to any auto insurance policy held by a driver required to obtain an SR-22 form from their insurance.

SR-22 insurance is only required if you’ve had a major traffic infraction. There are two ways it can be required:

-

Court-ordered: During your hearing, the judge will tell you it’s required

-

State-mandated: You will get a letter from the state

In most instances, you won’t have to worry about completing the SR-22 paperwork. Your insurance company will fill it out and file it with the state. However, not all insurance agencies offer them, so it’s possible that after your DWI, you’ll have to change insurance companies.

What Does an SR-22 Form Look Like?

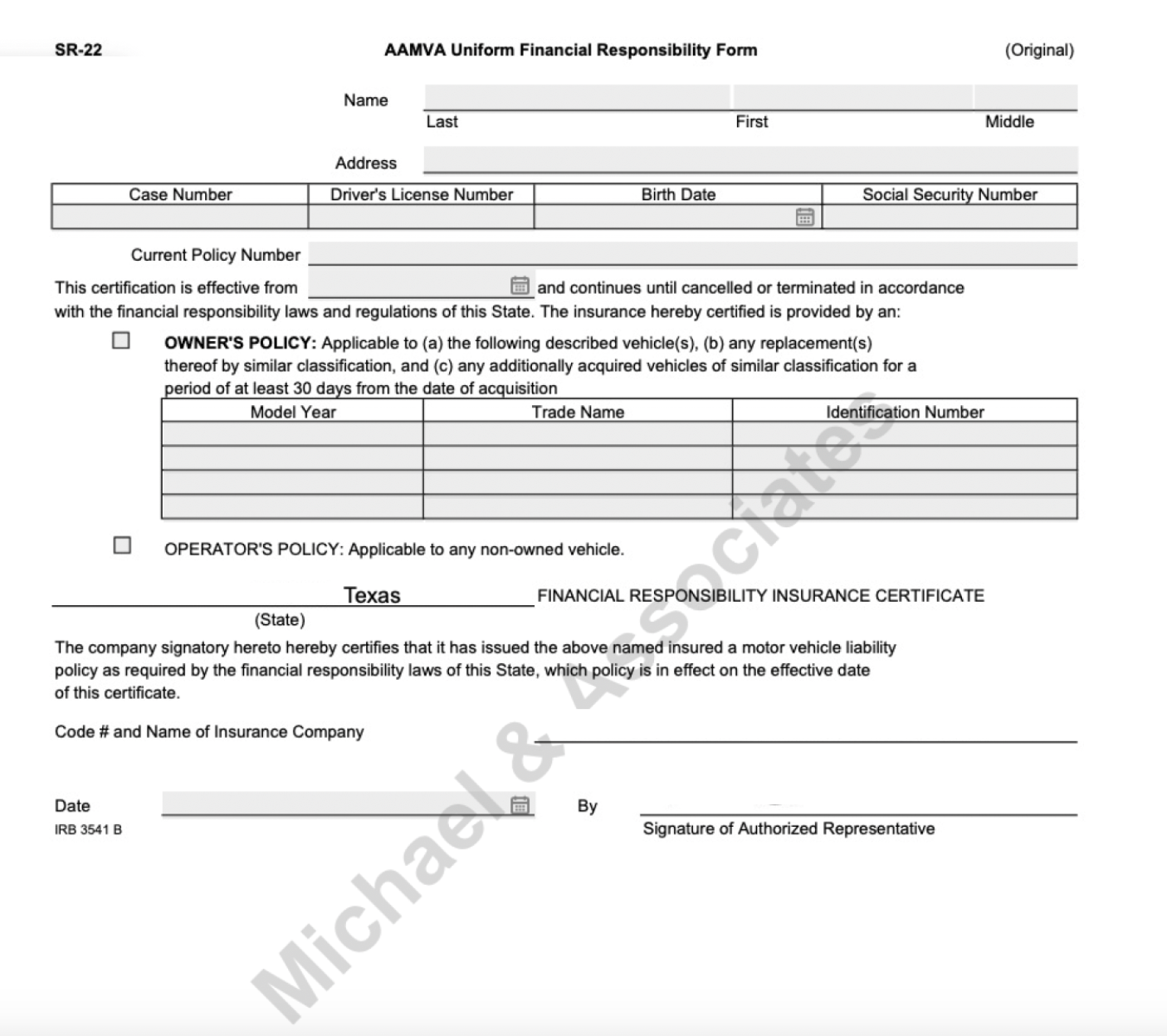

As mentioned previously, the look of an SR-22 might differ from insurer to insurer. Here’s an example of what a form looks like:

What Information is Required on an SR-22 Form?

While the exact information required varies by state, you should expect to provide the following information:

-

Name and address of insured driver

-

Insurance policy number

-

Driver’s license number of certificate holder

-

Social Security number

-

Birthdate

-

Effective date of SR-22

-

Date driver’s license was suspended

-

Expiration date or relief date (the date the SR-22 is no longer required)

-

Reason for SR-22 and any related conviction information

-

Trade name, model year and vehicle identification number (VIN) of insured vehicle

-

Checkboxes to note whether the certificate is for a vehicle owner or a vehicle operator (non-owner)

-

Name of insurance company

-

Insurance company’s official identification number from the National Association of Insurance Commissioners (NAIC)

-

Signature of authorized representative of insurance company

Why Do I Need SR-22 Insurance?

The reasons for needing SR-22 insurance vary from state to state. They include:

-

DWI/DUI convictions

-

Suspended driver’s license

-

Driving without insurance

-

Multiple traffic offenses

-

Causing an accident while uninsured

Typically, the SR-22 indicates that you’re considered a high-risk driver. It is not separate from your existing insurance policy. It is bundled with your existing policy, or you will have to get a new one if your insurer doesn’t offer SR-22 coverage. It may also be possible to purchase a separate “non-owner’s” policy from an independent insurer, bypassing your current insurance company. This can sometimes be a workaround to avoid a significant hike in your premiums.

Once you have the SR-22, clients must send us a copy. We may need to submit it as evidence at an Administrative Licence Revocation (ALR) hearing, which is an administrative hearing to prevent driver’s license suspension after a DWI in Texas, or to apply for an Occupational Driver’s License. You can also ask your insurer to send us a copy.

How to Get SR-22 Insurance

First, check with your current insurer to see if it offers SR-22 coverage. If not, you will need to contact insurers that offer it.

The minimum amount of coverage required with an SR-22 depends on the state. Most require a minimum amount of bodily injury liability and property damage liability coverage, and some may insist that you carry other kinds of coverage (such as personal injury protection or uninsured/underinsured motorist coverage).

Texas, for example, requires at least $30,000 in liability coverage for each injured person, up to $60,000 per accident, and $25,000 for property damage per accident. This basic coverage is known as 30/60/25.

How Much Does SR-22 Insurance Cost?

An SR-22 itself is inexpensive. The filing fee typically costs about $25. However, you will be labeled as a "high-risk" driver, and your insurance premiums will almost certainly increase. Your rate will increase by an average of 36%.

Additionally, you may be required to pay your entire premium, rather than paying it month to month, after an SR-22 is issued. If that’s the case, expect to come up with six or 12 months’ worth of premiums in a lump sum.

If you miss an insurance payment, you could wind up with a gap in your insurance coverage, and your policy could be canceled entirely.

States that Don’t Require an SR-22

Remember that not all states require SR-22s (or similar forms). The eight states that don’t require them are:

-

Delaware

-

Kentucky

-

Minnesota

-

New Mexico

-

New York

-

North Carolina

-

Oklahoma

-

Pennsylvania

Virginia and Florida require an FR-44 instead of an SR-22, though the form serves the same purpose.

More Commonly Asked Questions

How Long Does an SR-22 Stay on Your Record?

Each state sets rules regarding how long an SR-22 stays on your record. Generally, you should expect it to be on your record for three years, although it may range from one to five years. An SR-22 in Texas, for instance, is required for two years.

How Do I Remove an SR-22 From My Insurance?

An SR-22 won’t automatically be dropped from your insurance policy once it’s no longer needed. Instead, you must ask your insurer to remove it from your policy.

Your rate may decrease when the SR-22 is removed, but don’t get your hopes up. Since the price increase is tied to the infraction, your insurance rate could take several years to fall.

Additionally, if your policy lapses or is canceled while carrying an SR-22, your insurance company will alert the DMV and your driver’s license will be suspended.

What Happens if I Fail to Comply with an SR-22 Requirement?

Skipping the SR-22 is not a good idea. If a law enforcement officer catches you, you could:

-

Face jail time

-

Be required to pay significant fines

-

Have your car impounded

-

Your license could be suspended or even revoked

-

Be unable to register your vehicle

What’s the Difference Between an SR-22 and an FR-44?

SR-22 and FR-44 forms do the same thing, but the FR-44 is used in Florida and Virginia, both states that have imposed higher minimum liability limits. FR-22 states require minimum liability limits of $100,000 per person up to $300,000 per accident, and $50,000 for property damage.